Many people have no idea what Insurance Carrier Loss Runs are. Plus who wants to discuss or disclose malpractice claims just to get an insurance quote. Why won’t an insurer just quote without this information?

Many people have no idea what Insurance Carrier Loss Runs are. Plus who wants to discuss or disclose malpractice claims just to get an insurance quote. Why won’t an insurer just quote without this information?

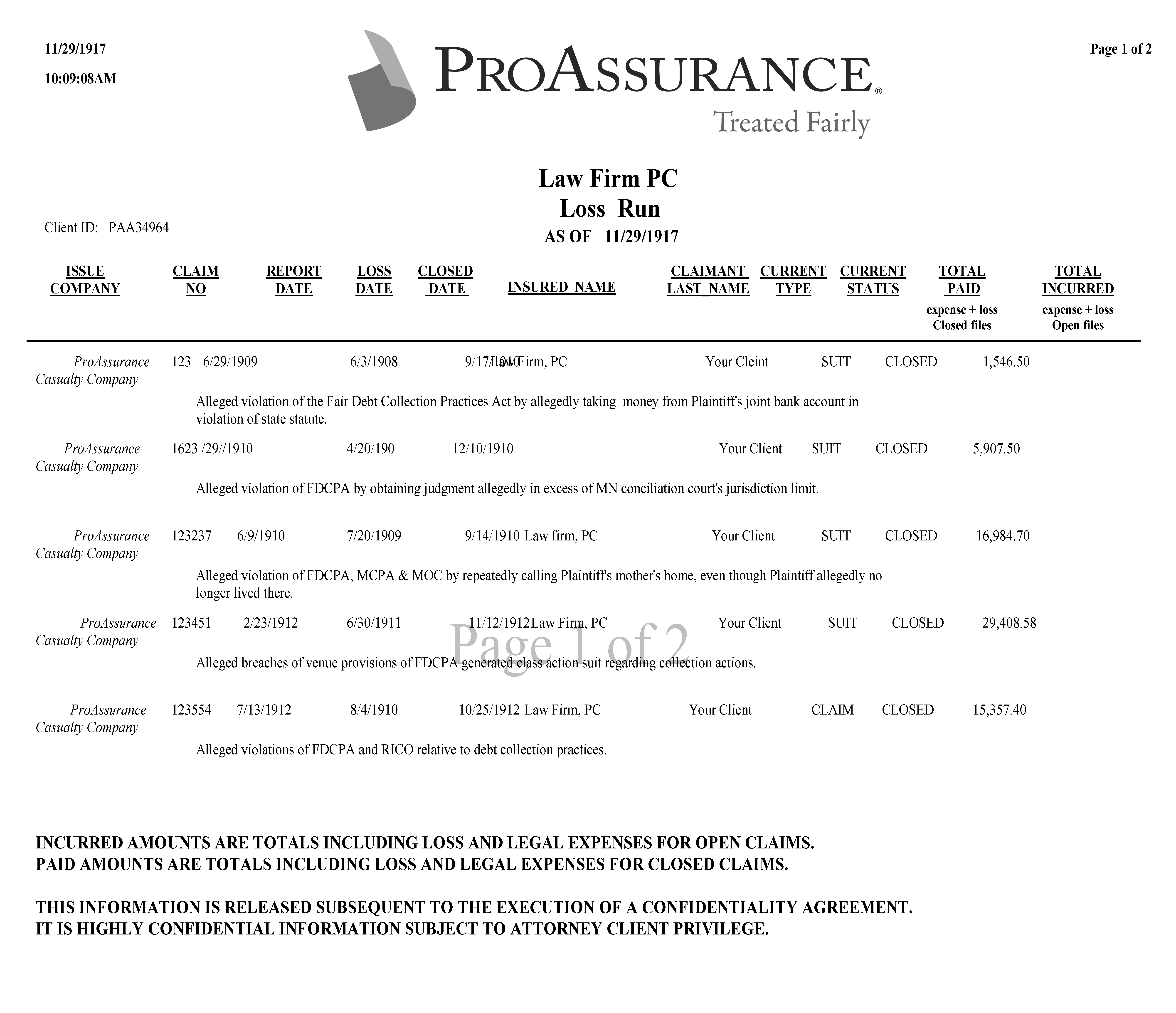

Insurance carrier loss runs are a report(s) that shows claims reported to a malpractice insurer during the time the firm was with the insurer. The loss run report can be generated by the insurer’s claims department or underwriting department. The firm being quoted should obtain the loss runs directly from the insurer(s) or agent(s) that formerly wrote the malpractice insurance. Normally all malpractice insurers that wrote your coverage in the last 5 years will need to supply loss runs. The firm may also have to sign a release to obtain the loss runs. The loss runs can show the claims; date claim is made; when the matter originated; amount reserved for claim (indemnity & expenses); amount paid for claim (indemnity & expenses); and whether open or closed. There is no standard format for loss runs or the data provided.

For many years, general commercial risk underwriters have required loss runs on every account but malpractice underwriters generally have been more selective in their requirements. Malpractice underwriters are now requesting insurance carrier loss runs with more frequency than in the past. If the firm has had a claim within the past 5 years count on having to obtain loss runs to get new business quotes. And don’t be surprised at being asked for loss runs at renewal for any open claim(s) that were made against a different insurer when the policy was first written by the incumbent insurer.

The uses for loss runs include:

1. Verify that the information on the application for claims reported and the amounts match what was disclosed. Often times the firm may or may not know the total amount that a claim was settled for or the claims expenses.

- If the inventory of claims does not match what was disclosed on the application you may be asked why.

3. With new business underwriting, if the incumbent insurer’s premium seems out of line the loss runs can verify that there are no hidden claims not disclosed by the firm.

4. With renewal accounts if there were open claims when first written by the current insurer, to see what development has happened to claim(s) over the past year and if it has been closed.

5. Declining claims coverage for claims previously reported to another insurer (remember this is claims made coverage).

Since past claims experience is one of the best predictors for future malpractice claims activity, the frequency and severity of claims is a key malpractice insurance underwriting component. Most underwriters will not even a give ballpark premium number for firms with reported claims without this vital tool.