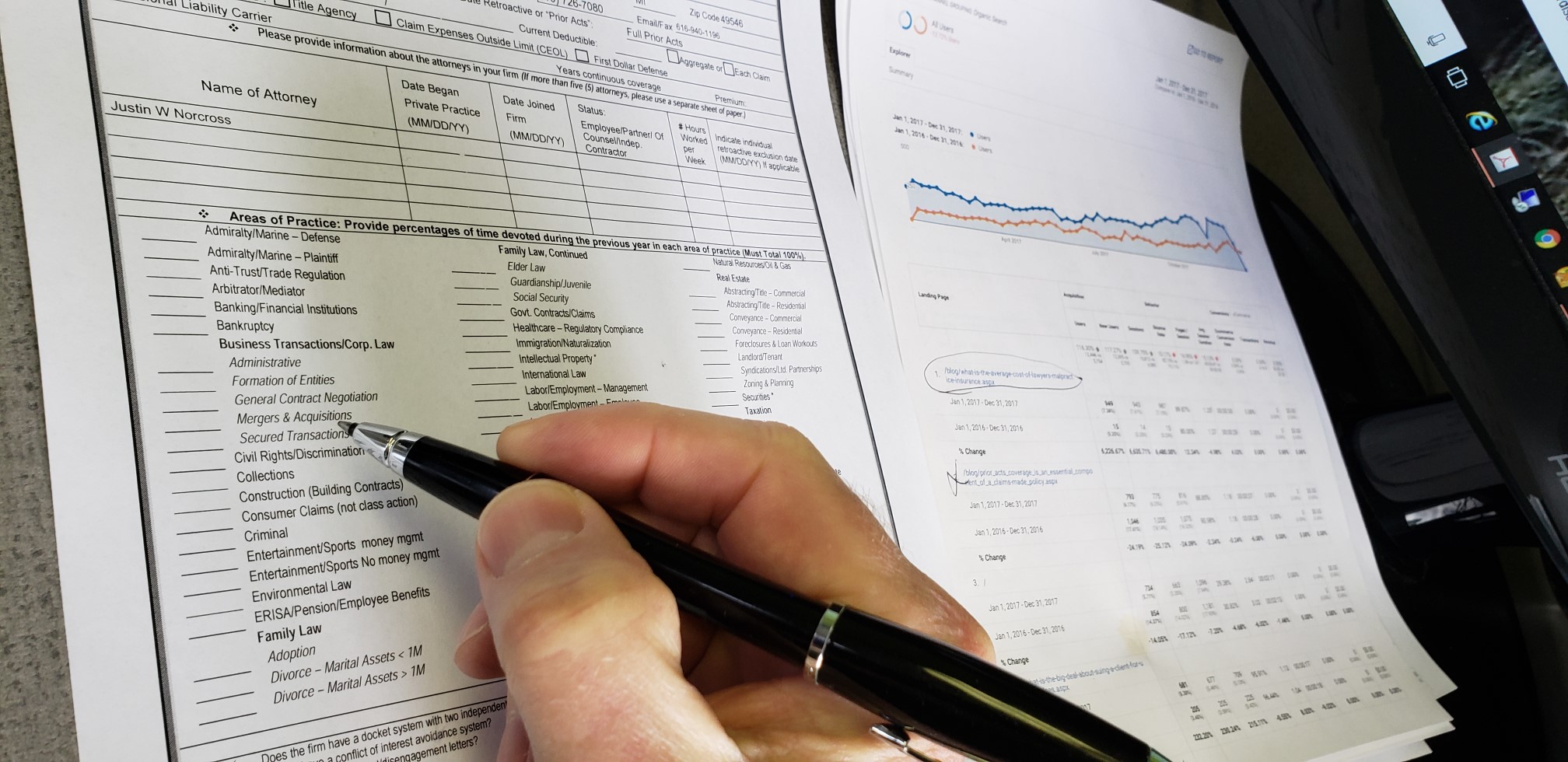

No one likes completing malpractice insurance applications. It is one of the more boring and stressful things to do. But properly completing the malpractice insurance application is very important. Even though this process takes away from billable hours, if done incorrectly it can lead to claims denied, the firm being non-renewed, or if the error is material enough coverage rescinded. If done correctly the first time, it might actually save your firm money on the malpractice insurance. So time spent on an application is time well spent.

No one likes completing malpractice insurance applications. It is one of the more boring and stressful things to do. But properly completing the malpractice insurance application is very important. Even though this process takes away from billable hours, if done incorrectly it can lead to claims denied, the firm being non-renewed, or if the error is material enough coverage rescinded. If done correctly the first time, it might actually save your firm money on the malpractice insurance. So time spent on an application is time well spent.

Malpractice insurance exposures can dramatically change from year to year. The time between when an act occurred and a claim being reported can be many years in the making. Malpractice insurers normally re-underwrite each firm annually. There are many reasons for this. If an accounting firm or law firm accepts a new client, that client may have needs in practice areas that the firm did not do work for in the past. The client could be a high profile client. The firm may also have grievances or claims that may not have been reported during the policy year. The underwriter will want an explanation as to what had caused the claim and what steps are being taken to prevent a future occurrence. Remember the malpractice policy is a claims-made policy. The firm not reporting a claim or grievance can set the firm up for a claim denial at a later date because of ‘Prior Knowledge’.

It is perfectly permissible to have an “assistant” complete the application, but the partner that is signing the application needs to thoroughly review the application for accuracy. Too often the assistant completing the application uses the answers from the prior year’s application to complete the new application. If an assistant is completing the application, make sure that the assistant polls the entire staff for any issues that might have arisen during the year that have led to or could lead to a malpractice claim. Problems arise if the prior year’s application is incorrect. The error that was made on a prior application can continue to propagate itself year after year. Too often, the only time the error comes to light is when a claim is made with the malpractice insurer. Firms need to exercise great care with the renewal apps as not properly answering any application questions can cause issues down the road.

If the incorrect application information is deemed material, the firm can learn the hard way that they have no coverage. The partner signing the application blaming the assistant for the error does not usually sway the claims department. It is the partner’s responsibility that signs the application to make sure that the application is accurate and properly reflects the operation of the firm.