Many law firms do not answer this attorney malpractice application question correctly. Basically, the insurer wants to know what you did last year. Emphasis on the ‘last’ year.

Many law firms do not answer this attorney malpractice application question correctly. Basically, the insurer wants to know what you did last year. Emphasis on the ‘last’ year.

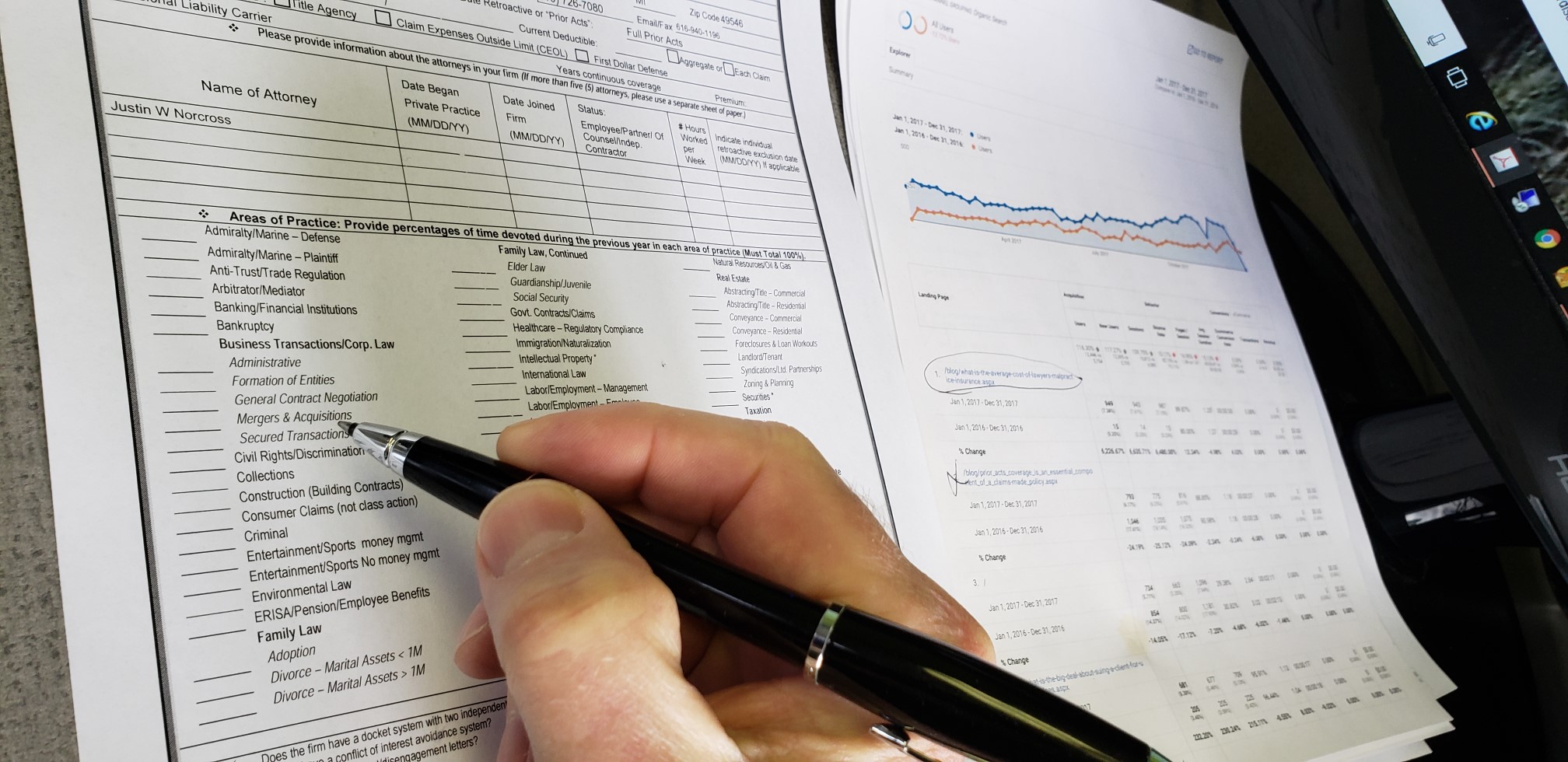

Law firms that do not properly read the area of practice question, which states something like, “give us the percentage of work (either billings or hours) that you have performed for in the past year for each area of practice.” It does not ask what you plan to do or hope to do in the next year. Some firms are hoping for a lower rate because they might switch the areas of practice for the coming year to a lower risk area of practice and are disappointed to find out they may have to wait another year for the premium change.

So, what is the reasoning for asking about last year and not the coming year?

1. Remember this is claims-made insurance. The policy is insuring for past acts, not future acts.

2. Just because a firm plans to do something in the next year, does not mean that will happen. Plans change.

If the firm decides to answer the question how they want it asked not how it is asked, complications can arise. In some cases, these issues are caught because the supplements associated with certain areas of practice cannot be filled out correctly. For instance, the real estate supplement might ask how many closings the firm did in the past year or the average value of the real estate transactions. When the supplement comes back with all zeros, it is easy to determine that no real estate work was done. This error causes delays in getting attorney malpractice terms for the law firm once the errors are corrected.

Some law firms might perceive this to be no big deal. When not answered correctly, it could lead to claims being denied (an extreme case), but likely additional underwriting questions or a premium may be much higher or lower than it should be. Or coverage could be declined or non-renewed.

With many malpractice insurance underwriters, once declined, it can be very difficult to convince the underwriter to look at the account with “new” information. Underwriters tend to be a very suspicious group. If the firm answers the questions as posed and does not make up their own questions, they will make life easier on themselves and ‘insure’ that their coverage is valid.

|

Contact Me Today

Lee Norcross, MBA, CPCU (616) 940-1101 Ext. 7080 |