Many of the Lawyers Professional Liability Insurance Mutual Companies are licensed in very few states. Some Mutual Insurance Companies are only licensed in their domiciled state. Often times they required the law firm if they are going to accept clients in another state to get a 2nd policy for the other state. We have actually had a few law firms have 3 policies in 3 different states.

This problem is not just limited to the Mutual companies. Many Stock Lawyers Professional Liability insurance carriers are not licensed in all states or do not wish to do business with law firms that have clients in certain states.

Having multiple polices, in addition to the expense, can lead to many different coverage issues, especially for firms that have clients that they do work for in multiple states. The “Other Insurance” clause found in most Lawyers Professional Liability Insurance Policies could come into play complicating coverage and settlement issues. The following is a typical “Other Insurance” clause from a Wesco Insurance Company policy:

“E. Other Insurance

If there is other insurance that applies to the claim, this insurance shall be excess over such other valid and collectible insurance whether such insurance is stated to be primary, contributory, excess, contingent or otherwise. This does not apply to insurance that is purchased by the Named Insured specifically to apply in excess of this Policy.”

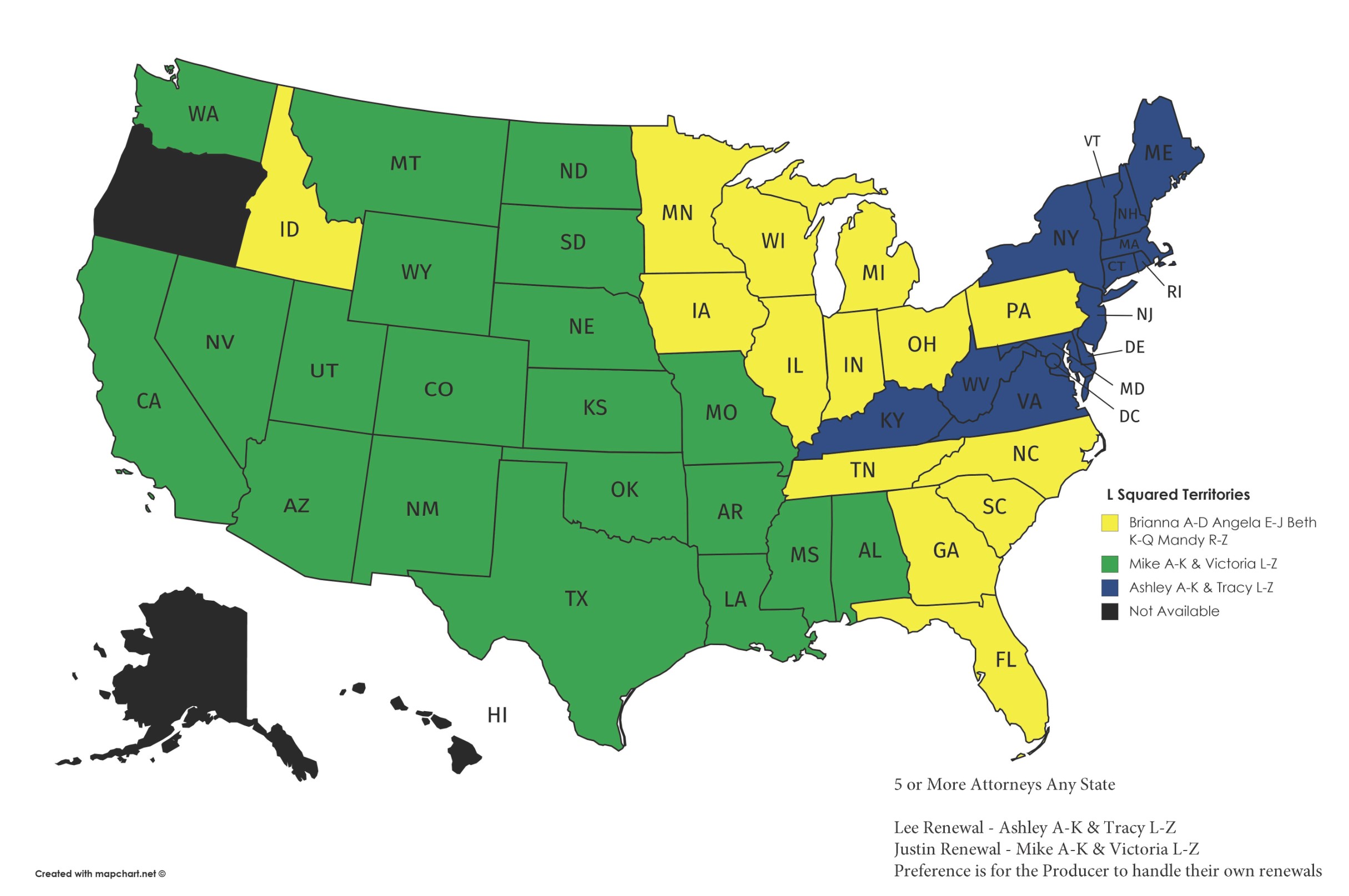

As you can well imagine, having 2 or 3 policies with similar language could bring a lot of parties to the table with certain claim. Best course of action is to combine the insurance coverage with a single Lawyers Professional Liability Insurance Carrier and Insurance Agency such as L Squared Insurance Agency which is licensed in 47 states plus DC.