A law firm has clients with business in many states, but their insurer is only licensed in one state. Or the law firm has offices in different states, which creates a similar problem. In the past we have helped law firms with 3 different policies in 3 different states go to one policy for the 3 different states at a significant premium savings. This also provides more comprehensive coverage.

This particular problem is common with Attorney Malpractice Mutual Insurers. Some are only licensed in their domiciled state. Often, they require the law firm to get another policy for a different state if they are going to accept clients that are in another state.

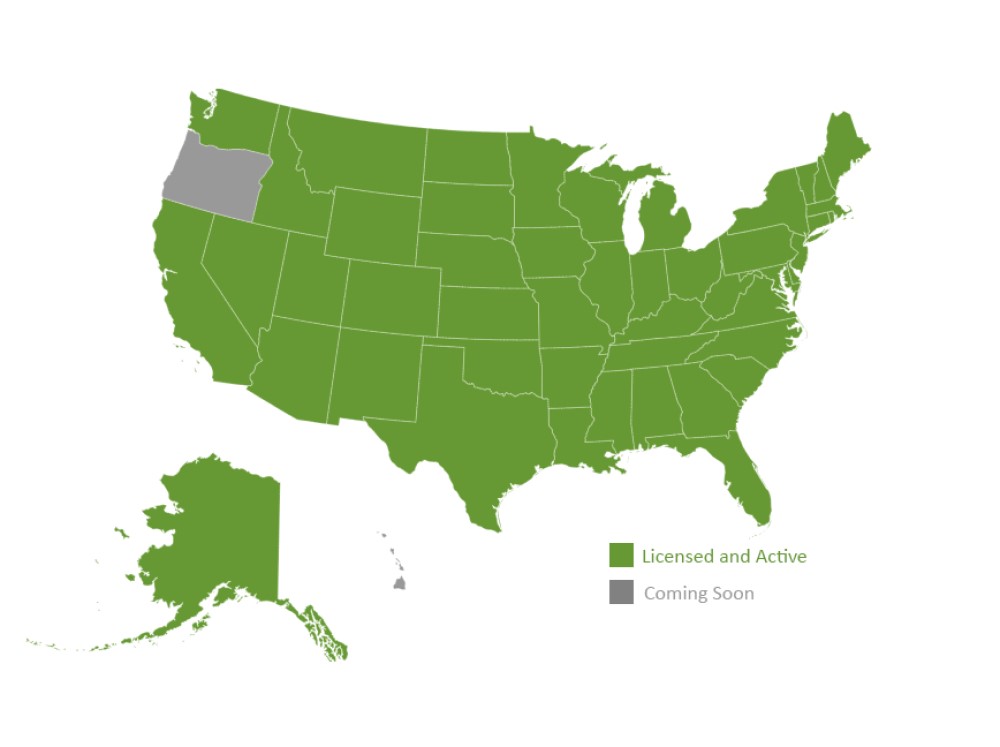

This problem is not just limited to the Mutual Insurers. Some Stock Attorney Malpractice Insurers are not licensed in all states and/or exclude coverage for a law firm’s clients or offices in a certain state.

In addition to the expense, multiple policies can lead to coverage issues. For instance, if the law firm’s client brings an allegation of malpractice that is not limited to just one state, there may be multiple policies and insurers that must answer. This can trigger the ‘Other Insurance Clause’. The “Other Insurance Clause’ found in most Insurance Policies complicates coverage defense and settlement issues. The following is a typical ‘Other Insurance Clause’ from a Wesco Insurance Company Attorney Malpractice Policy:

“E. Other Insurance

If there is other insurance that applies to the claim, this insurance shall be excess over such other valid and collectible insurance whether such insurance is stated to be primary, contributory, excess, contingent or otherwise. This does not apply to insurance that is purchased by the Named Insured specifically to apply in excess of this Policy.”

Having 2 or 3 insurance policies with dissimilar ‘Other Insurance Clauses’ brings a lot of parties to the table. Each insurer’s policy language when it interacts with another insurer’s policy can complicate the insurers’ responses to the claim. The best course of action is to find a single Attorney Malpractice Insurer to cover all the law firm’s legal malpractice needs as well as one insurance agency such as L Squared to find the appropriate insurer.

Although a topic for another blog, this is also why law firms with inadequate liability limits from one insurer need to purchase excess insurance coverage, not another primary policy, and to make sure the excess policy is ‘Following Form’.

Lee Norcross, MBA, CPCU

(616) 940-1101 Ext. 7080