Attorney Malpractice Insurance Policies are claims-made and reported policies. When the coverage ends the ability to report claims for past acts ends at policy termination. Attorneys leaving private practice via retirement, becoming a judge or working in the private or public sector need to protect their past acts. Insurers will not renew attorney malpractice policies for attorneys that are no longer in private practice. Given this it is important for attorneys to protect their past acts once coverage ends. For solo practitioners and small firms that may close once the practitioner leaves, the nonpracticing Extended Reporting Period Endorsement/Retirement Tail (ERP) may be an answer.

Note: For attorneys closing or leaving their small firm to work at another law firm the nonpracticing Extended Reporting Period Endorsement/Retirement Tail (ERP) is not an option. Coverage for their past acts is outside of the scope of this blog.

Each insurer’s policy differs on requirements and wording for obtaining this valuable ERP endorsement at no or reduced cost. Careful planning by the attorney may save the attorney thousands of dollars. The ability to request an ERP differs by insurer but is time sensitive. Regardless of the insurer, the attorney must completely stop private practice to obtain the nonpracticing ERP.

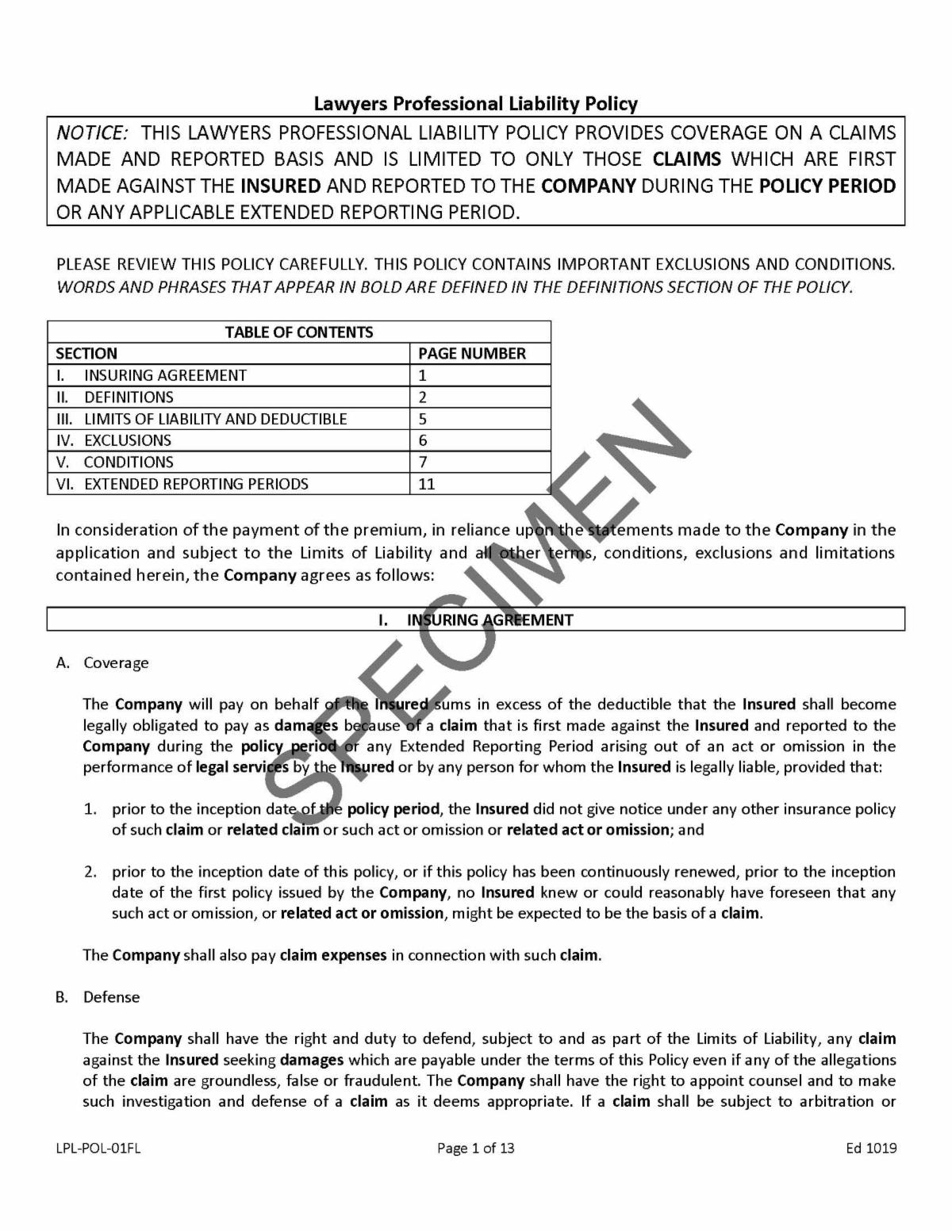

The Corepointe policy provides a nonpracticing ERP based on the following policy language:

VI. EXTENDED REPORTING PERIODS

C. Non-Practicing Extended Reporting Period:

If an Insured dies or becomes totally and permanently disabled during the policy period, then upon the latter of the expiration of: the policy period; any renewal or successive renewal of this Policy; or any Automatic or Optional Extended Reporting Period, the Insured shall be provided with a Non-Practicing Extended Reporting Period as provided below:

1. In the event of death, the estate, heirs, executors or administrators of such Insured must provide the Company with written proof of the date of death. This Non-practicing Extended Reporting Period is provided to the estate, heirs, executors and administrators of such Insured until the executor or administrator of the estate of such Insured is discharged.

2. If an Insured becomes totally and permanently disabled, such Insured or such Insured’s legal guardian must provide the Company with written proof that such Insured is totally and permanently disabled, including the date the disability commenced and certified by the Insured’s physician. The Company retains the right to contest the certification made by the Insured’s physician and it is a condition precedent to this coverage that such Insured agree to submit to a medical examination by any physician designated by the Company.

This Non-Practicing Extended Reporting Period is provided until such Insured shall no longer be totally and permanently disabled or until such Insured’s death in which case subparagraph 1. hereof shall apply.

No additional premium will be charged for any Non-Practicing Extended Reporting Period.

D. Retirement Extended Reporting Period:

If an Insured, except those attorneys under Definitions F.3, retires or otherwise voluntarily ceases, permanently and totally, the private practice of law during the policy period and has been continuously insured by the Company for at least three consecutive years, then such Insured shall be provided with a Retirement Extended Reporting Period commencing upon the latter of the expiration of: the policy period; any renewal or successive renewal of this Policy; or any Automatic or Optional Extended Reporting Period.

This Retirement Extended Reporting Period is provided until such Insured’s death in which case subparagraph C.1. above shall apply or until such Insured shall resume the practice of law.

No additional premium will be charged for any Retirement Extended Reporting Period.

E. Elimination of Right to Any Extended Reporting Periods

There is no right to Extended Reporting Periods if the Company shall cancel or refuse to renew this policy due to:

1. non-payment of any amount due under this policy; or

2. non-compliance by an Insured with any of the terms and conditions of this policy; or

3. any misrepresentation or omission in the application for this policy, or if at the time this right could be exercised by an Insured, such Insured’s license to act as a legal professional has been revoked, suspended or surrendered at the request of any regulatory authority.

II. DEFINITIONS

G. “Insured” means the Named Insured, predecessor firm and the persons or entities described below:

1. 1. Any lawyer, partnership, professional corporation, professional association, limited liability corporation or limited liability partnership who is or becomes a partner, officer, director, stockholder-employee, associate, manager, member or salaried employee of the Named Insured during the policy period shown in the Declarations;

2. Any lawyer previously affiliated with the Named Insured or a predecessor firm as a partner, officer, director, stockholder-employee, associate, manager, member or salaried employee but only for legal services performed on behalf of the Named Insured or a predecessor firm at the time of such affiliation;

3. Any lawyer, law firm, partnership, professional corporation, professional association, limited liability corporation or limited liability partnership who acts as Of Counsel to the Named Insured or any non-employee independent contractor attorney or per diem attorney to the Named Insured but only for legal services performed on behalf of the Named Insured;

4. Any former or current employee who is a non-lawyer of the Named Insured or any predecessor firm, but solely for services performed within the course and scope of their employment by the Named Insured or any predecessor firm;

5. The estate, heirs, executors, administrators, assigns and legal representatives of an Insured in the event of such Insured’s death, incapacity, insolvency or bankruptcy, but only to the extent that such Insured would have been provided coverage under this Policy.

J. “Named Insured” means the persons and entities designated in the Declarations.

Switching insurers near retirement to save a few dollars may cost an insured attorney thousands of dollars to buy the same protection. Planning retirement or a transition out of private practice should be discussed with your malpractice insurance agent prior to ending private practice when possible.

CLICK HERE TO OBTAIN AN ATTORNEY MALPRACTICE QUOTE

Lee Norcross, MBA, CPCU

(616) 940-1101 Ext. 7080