Attorneys wear many hats. Attorney malpractice insurance provides coverage for most hats but not all. A malpractice insurer’s definition(s) of professional services may cause coverage issues for attorneys that perform certain client services. If the services are provided using a license other than a law license, it is a good bet that it is not covered. When looking for the appropriate insurer, check the professional services definition against the services that your law firm provides.

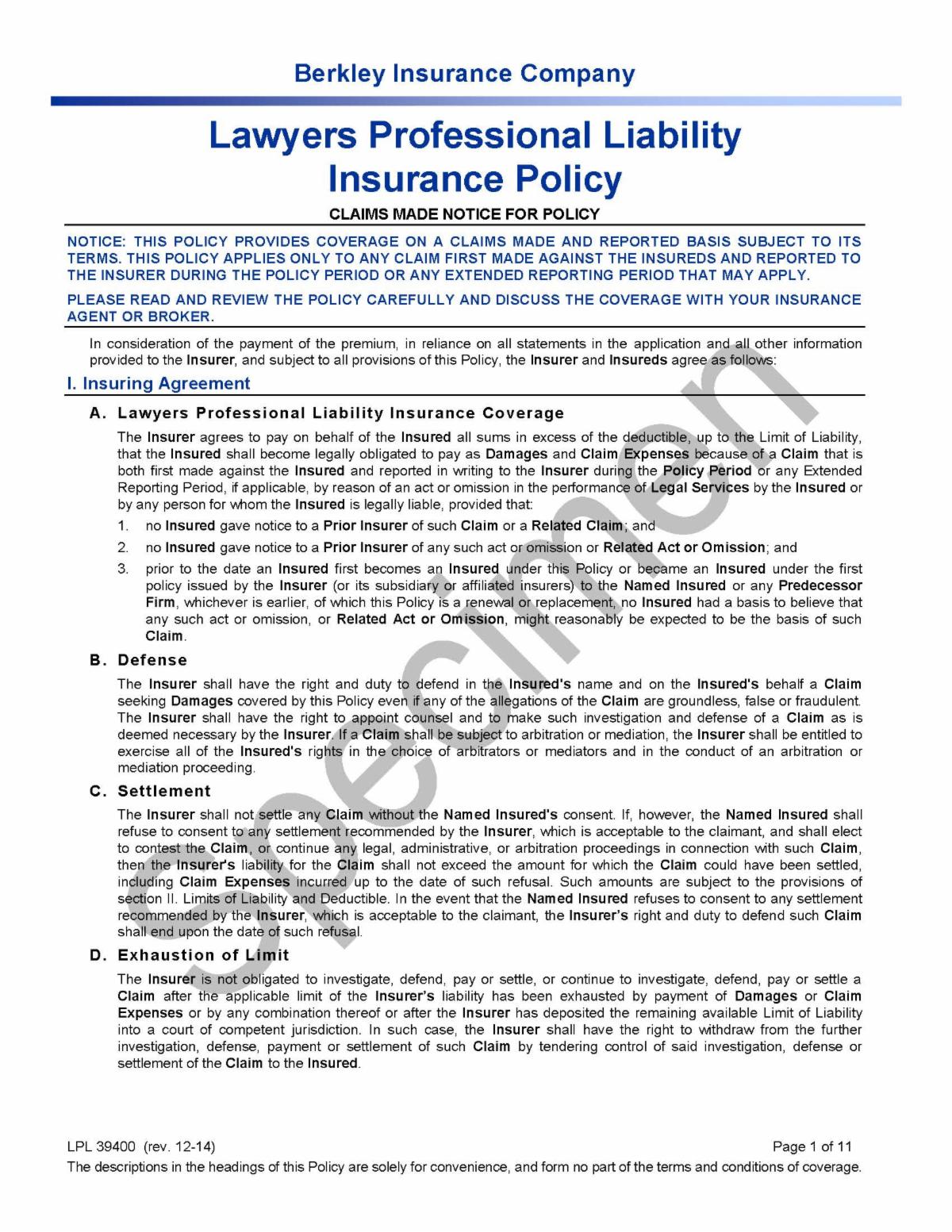

Berkley defines Professional (Legal) Services as:

III. DEFINITIONS

H. Legal Services means:

1. those services, including pro bono services, performed by an Insured for others as a lawyer, arbitrator, mediator, title agent or other neutral fact finder or as a notary public. Any title agency or insurer, on whose behalf the Insured acts as title agent or designated issuing attorney, is not an Insured under this Policy unless such title agency is a wholly owned subsidiary of the Named Insured;

2. those services performed by an Insured as an administrator, conservator, receiver, executor, guardian, trustee or in any other fiduciary capacity;

3. those services performed by an Insured in their capacity as a member of a bar association, ethics, peer review, formal accreditation, licensing, or similar professional board or committee related to the legal profession, or

4. those services performed by an Insured as an author, strictly in the publication or presentation of research papers or similar materials and only if the fees, royalties or other revenue generated from such work are not greater than $10,000.

For the purpose of this definition, services performed by an Insured in a lawyer-client relationship on behalf of one or more clients shall be deemed Legal Services in the Insured’s capacity as a lawyer, although such services could be performed wholly or in part by non-lawyers.

IV. EXCLUSIONS

F. Capacity as Director, Officer, Fiduciary

to any Claim based on, or arising out of, or in any way involving an Insured’s capacity as:

1. a former, existing or prospective officer, director, shareholder, partner, manager or member (or any equivalent position) of any entity if such entity is not named in the Declarations;

2. a trustee of a pension, welfare, profit-sharing, mutual or investment fund or investment trust; or

3. a fiduciary under the Employee Retirement Income Security Act of 1974 and its amendments or any regulation or order issued pursuant thereto or any other similar state or local law; provided, however, this exclusion does not apply to a Claim based on, or arising out of an Insured’s capacity as a member, director or officer of any professional legal association, including any Bar Association and any similar organization or association, its governing board or any of its committees;

G. Capacity as Public Official

to any Claim based on, or arising out of, or in any way involving an Insured’s capacity as a public official or an employee or representative of a governmental body, subdivision or agency unless such Insured is deemed as a matter of law to be a public official or employee or representative of such entity solely by virtue of rendering Legal Services to it;

H. Owned Entity

to any Claim based on, or arising out of, or in any way involving Legal Services performed, directly or indirectly, for any entity not named in the Declarations, if at the time of the act or omission giving rise to the Claim, the percentage of ownership interest, direct or indirect, in such entity by any Insured, or an accumulation of Insureds, exceeded 10%;

J. Securities Exclusion

to any Claim based on, or arising out of, or in any way involving:

1. the promotion, sale or solicitation for sale of securities, real estate, or other investments by any Insured; or

2. recommendations, representations, or opinions concerning specific investment advice by any Insured or any person or organization referred to by any Insured or any person or organization referred to by any Insured in connection with portfolio or trust account management, or the performance or nonperformance of securities, real estate, or other investments;

L. Employee Retirement Income Security Act Exclusion

to any Claim based on, or arising out of, or in any way involving any actual or alleged violations of the Employee Retirement Income Security Act of 1974 and amendments thereto by any Insured while acting as a fiduciary within the meaning of said Act; provided, however, this exclusion shall not apply to a Claim arising out of an act or omission committed by an Insured in the performance of Legal Services to a fiduciary as otherwise provided by the Policy.

CLICK HERE TO OBTAIN AN ATTORNEY MALPRACTICE QUOTE

This blog is an excerpt from the policy. The complete policy along with applicable endorsements could impact the information provided above.

Lee Norcross, MBA, CPCU

(616) 940-1101 Ext. 7080