With non E&O commercial insurance it is normal practice for Insurance carriers to require loss runs to provide a quotation. Insurance carrier loss runs are a report produced by an insurance carrier that provides information on all claims that have been reported to an insurance carrier during the time that the insurance carrier provided insurance coverage. With Lawyers Professional Liability Insurance the loss runs not only include actual claims paid, but incidents that may not ever turn into a claim and disciplinary proceedings.

With non E&O commercial insurance it is normal practice for Insurance carriers to require loss runs to provide a quotation. Insurance carrier loss runs are a report produced by an insurance carrier that provides information on all claims that have been reported to an insurance carrier during the time that the insurance carrier provided insurance coverage. With Lawyers Professional Liability Insurance the loss runs not only include actual claims paid, but incidents that may not ever turn into a claim and disciplinary proceedings.

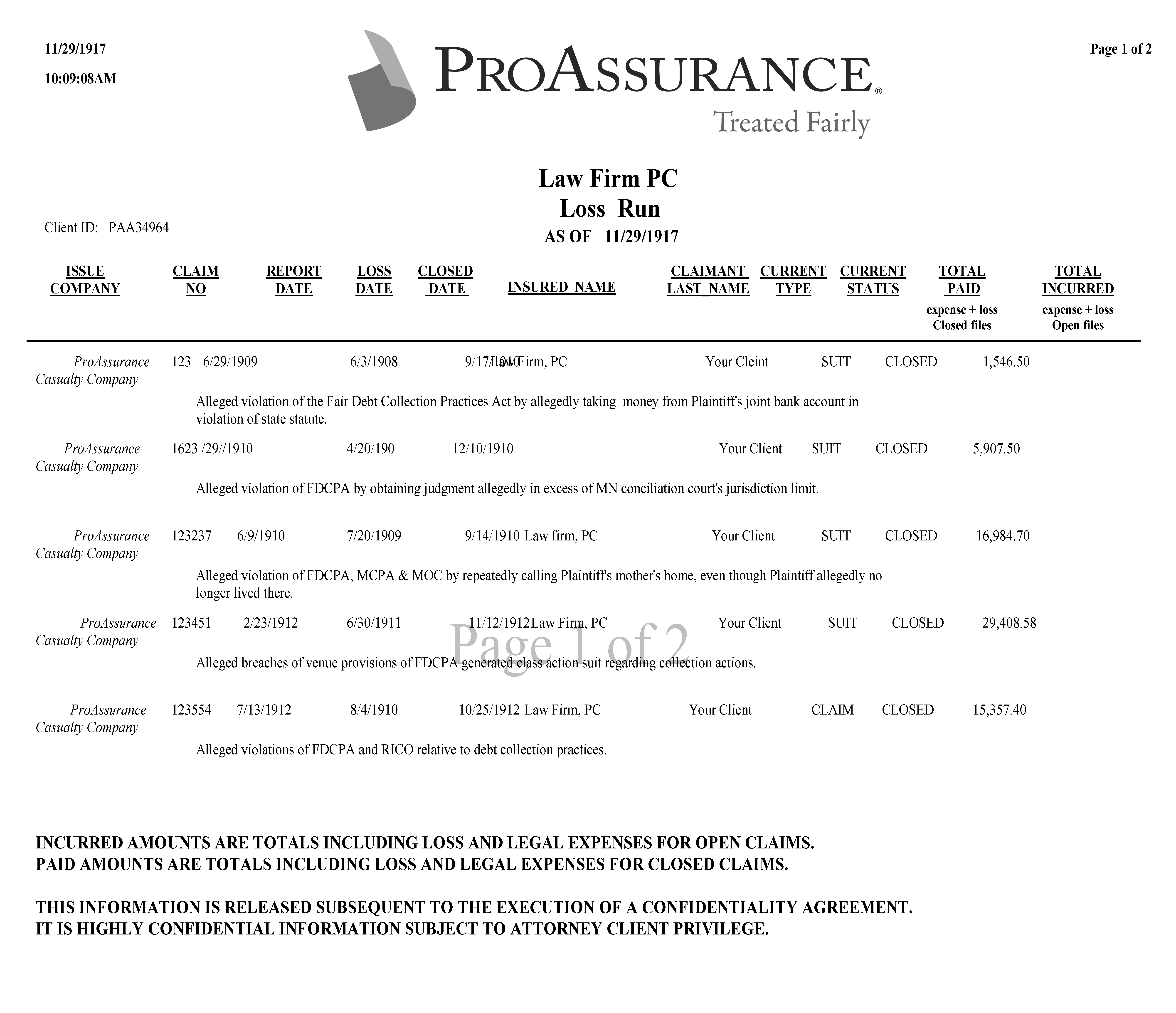

Every insurance carrier’s practice as to what information is reported differs slightly. The loss runs can include; policy year claim made, date claim made, claim number, claimant or party reported claim, if claim is open or closed, if closed with closed, indemnity amount paid, claims expenses, amounts reserved for the claim, etc. As claims information is considered confidential information of the insured, it usually requires a written release of some type from the insured and/or insured’s agent to obtain the loss runs. Every state insurance department requires that carriers release loss information to the insured in a timely manner when requested in writing or other acceptable means.

Insurance carrier loss runs are a key underwriting tool for assessing an insurance exposure and providing proper coverages and pricing. It is common practice for an attorney malpractice underwriter to require loss runs in the following situation:

1. Claims from another carrier are indicated on the application or indication form

2. Disciplinary matters were reported on the application

3. The law firm has been “non-renewed” in the past

4. The law firm has purchase an ERP (Extended Reporting Period Endorsement)

5. There has been a gap in coverage for an unexplained reason

6. The law firm’s premium is unusually high given the normal exposure for this type of law firm

7. The law firm has been written by a surplus lines carrier that is known to specialize in distressed law firms.

Any of the above reasons not only affects potential pricing for a law firm, but likely impacts the acceptability of the law firm for a particular insurance carrier’s attorney malpractice program. It is not unusually for an underwriter to refuse to provide any terms if any of the above factors are noted without first seeing insurance carrier loss runs.